006 Bonds and Loans

Chapter 6 of 'There are no grown ups'

Most of us understand property and its financing rather better than the financing of companies & governments. Whether as renters, buyers using a mortgage, or cash buyers, or as the children of those providing our home, property is understood from personal experience

Say someone is buying a house with a £100,000 interest-only 25 year mortgage. As the buyer, they may have been worrying about dozens of things about the house: proximity of schools / green spaces / the sea / public transport / their place of work, number of bedrooms, garden/garage, design of kitchen/bathrooms, etc. But as an investor we need to put ourselves in the shoes of the bank lending the money, so only 3 things really matter.

a) How much interest will the borrower pay?

b) How likely is it that the borrower will fail to keep up payments?

c) If the borrower does not keep up payments, will the lender be able to get their money?

Consider the two mortgages detailed below

Both Mortgages are £100,000 interest only mortgages running for a further 25yrs

Mortgage 1 | Mortgage 2 | |

Interest payable | 3% = £250pcm (£75,000 over 25yrs) | 6% = £500pcm (£150,000 over 25yrs) |

Risk the borrower won’t pay | Very small, the borrower has post tax income of £6,000 pcm from a job they have held for 10yrs | Not known. The borrower ‘self-certified’ their income which comes from their new occupation of crypto currency trading |

Ability to get money if the borrower does not keep up payments | Very good, as long as the market does not crash by more than 50%. The House was purchased for £200,000 (ie only a 50% mortgage), | Depends on house price growth. House was purchased for £100,000 (ie a 100% mortgage) |

Which of these mortgages is the best investment for the bank? That depends on the unknowable: ‘what does the future hold’. Lets look at a few possibilities

Value to the bank of Mortgage 1 | Value to the bank of Mortgage 2 | |

Future 1: Interest rates increase to 5% and house prices increase by 10% | The bank looses money. Had it kept its £100,000 in cash it could have lent it out for the new higher interest rate of 5% (=£417 pcm). The increase in house value to £220,000 is irrelevant to the bank | The bank may still make money. The 6% interest rate is still better than it could be certain of achieving making a new loan, and the riskiness of the loan has declined as the house is now worth £110,000 |

Future 2: Financial crisis, Interest rates increase to 10%, house prices fall by 30% | The bank looses money. . Had it kept its £100,000 in cash it could have lent it out for out for the new higher interest rate of 10% (=£833 pcm). The bank would gain massively if the borrower defaulted so that the bank got its money back from a repossession sale, and was then able to put it into a new loan yielding 10%. | The bank looses money. It is receiving interest of £500pcm when a new £100,000 loan to a good-credit borrower would give it £833pcm. If the borrower defaults the bank will get back no more than £70,000. Curiously default may be the least bad option for the bank as if it got £70,000 back it could make a low-risk loan that would give it £583pcm interest |

Future 3: Bank bailout scenario. Interest rates are cut to 1%, house prices rise by 30% | The bank makes money and is glad to have a 3% yield when new loans are making only 1% | The bank makes money. It is very happy with the 6% interest for as long as it receives it and, if the borrower’s crypto currency trading does not work out, it would get its cash back in a repossession sale[1]. |

In looking at ‘Future 1’, ‘Future 2’ and ‘Future 3’, I have said that the bank loses money when increasing interest rates mean that it could have earned more interest by not granting the mortgage, sitting on the cash, and lending it out at a later date when interest rates have risen. One could say that the bank was still making money in nominal terms[2], inasmuch as it was getting back more than it lent. But, treating a rate rise as creating a loss, certainly makes sense when taking the next step: moving from thinking about the mortgage as a contract between a bank and a homeowner, and instead thinking about it as a tradeable investment.

When banks have granted a mortgage, it is rare for them to sell on the individual mortgage, but, in the late 1970s Lew Ranieri at wall street investment bank Salomon Brothers created ‘Mortgage bonds’ out of groups of mortgages. Take a thousand £100,000 mortgages with a total value of £100 million, yielding 10% (this was the 1970s) and create a million bonds each with a notional value of £100, and paying annual interest of £10 with the £100 principal repayable in 25 years time. If you are considering spending £100 of your money on such a bond, you are not necessarily set on holding it for 25 years and, even if you are, should you care to look, you will see its value fluctuate daily.

The process of pooling mortgages and then splitting the pool into a million bits is not only useful in real life, it helps us to move from looking at a series of £100,000 loans made by a bank to thinking about investing £100. If we make that investment, we join the ranks of those making fixed coupon bond investments. The value of our investment will be driven by the same three factors that were relevant to the bank

- The interest raise we revive relative to the prevailing rate (as rates go up the value of our investment goes down; and if rates go down the value of our investment goes up)

- The creditworthiness of the borrower (if they become less creditworthy the value goes down, if they become more creditworthy the value goes up)

- The value of the collateral (if any) we can claim if payments are not made (the collateral value less recovery costs represents the extent to which investors are insured against default)

The relative significance of these factors tends to depend on the duration of the bond (loan).

If we are at the start of a 25year arrangement, then the interest paid over those 25years is likely to be very important, possibly more important than the eventual capital repayment. Over the life of the bond mentioned earlier, you expect to receive interest of £10/yr x 25yrs = £250 interest plus the £100 repayment of principle in 25yrs time. A total of £350. If, after you buy the bond, interest rates rise to 20%, investors can acquire the same £10/year coupon for a loan/investment of only £50. The only difference between the original £100 bond yielding £10/yr and the new post rate-rise bond yielding £10/yr is that in 25 years time the capital repaid on the original bond is £100 while the new one repays only £50. In a world of 20% interest rates, the value today of that £50 in 25years time is £50 x 0.825= 19p. In other words, the increase in interest rates means you have lost half your money.

Roll forward 24years. If we are at the start of year 25, and there is only one year left to maturity, then creditworthiness (and/or the insurance represented by the collateral) is likely to be the most Important consideration: will they actually be able to repay the £100 at the end of the year is more important than whether the interest they will pay that year is £10 (or £5 or £15).

Various types of bonds

Bonds are characterised by

Issuer:

· Central Governments (UK gilts, US Treasuries, German Bunds, Japanese JGBs)

· Local governments (US municipal bonds etc)

· Companies raising money for their own use (corporate bonds)

· Companies creating a bond from an underlying third party asset (mortgage bonds, car loan bonds, etc)

The way the interest is paid

While mortgages usually involve monthly payments, bond interest payments (coupons) are usually annual (once a year) or Semi annual (twice a year).

Some bonds, known as ‘zero coupon bonds’ don’t involve any interest payments. If a bond is going to run for a year or less (eg US Treasury bills) it can be easier to avoid the administrative step of having a coupon and instead the issuer/borrower receives less than the ‘face value’ that they must repay on maturity. Eg you pay £90 for a bond that will pay you £100 in a years time. Returning to the mortgage analogy, consider a homeowner wanting to build an extension. Once the extension is built they may be able to enlarge their mortgage to cover the build cost but, until it is built, they need financing to pay their builders/suppliers, so they borrow £22,500 on which the interest is ‘rolled up’: in a years time (when the project is over and, all being well, they can refinance) they must repay £25,000 to the bank.

The type of interest

So far we have considered fixed interest loans / bonds, but some bonds pay a variable rate (just as mortgage borrowers sometimes have ‘tracker’ loans on which the interest is linked to an official figure such as the base rate / LIBOR) and some are ‘index linked’ and pay a defined amount above (or, in this crazy world, sometimes below) the official inflation figure.

Where a bond is eg secured on a pool of underlying mortgages that start with a discounted rate and then move to a tracker rate after 2-3 years, the bond is likely to mirror those characteristics - ie low initial interest payments that then (all being well) increase

The level of interest

Fixed rate: eg 5%

Variable rate: eg base + 50 basis points (1/2%)

Index linked: eg RPI + 50 basis points (1/2%)

The nature of the underlying collateral

Bonds secured against mortgages or car loans may initially look similar, and be priced largely based on the Interest rate (yield) they offer. But, there can be vast differences in the collateral underlying the bonds and, when push comes to shove, those differences can make all the difference.

The best way of understanding the nature of bonds secured on residential mortgages, is to read, ‘The Big Short’ by Michael Lewis. It is very readable, entirely accessible to non financiers, and available as an audio book which runs to just under 10houts. The film version at 2hrs 10minutes necessarily omits a lot of important detail.

The duration

Bonds that are due to be repaid soon are known as ‘short dated’. A strategy that involves Investing in them is likely to involve work, not least as when the issuer (borrower) repays the money at maturity, you then have to make a decision about where to invest the proceeds.

Long dated bonds, with maturities of 25-30 years or more, often purport to offer long term predictability. If you lend sterling to the UK government or US dollars to the US government, they are almost certain to be able to pay the coupons and return the principle when it falls due. The reason for being confident about this is that they control the printing presses, and electronic equivalents, so, absent anything else (eg if tax receipts fall short) they can always create new money with which to pay you. What that money will buy is another matter (see Weimar Germany in the 1920s or Venezuela in 2018 for examples)

What can go wrong investing in bonds?

As with all investments, losses tend to come from paying too much in the first place. But how much is too much?

Absolute losses in nominal terms are guaranteed if you pay more for the bond than you will receive back in total (interest or coupon payments, plus the principle repayment at maturity). In the case of the example £100 25yr bond with an annual £10 coupon, the best case scenario is that the buyer receives interest of £10/yr x 25yrs = £250 interest plus the £100 repayment of principle in 25yrs time. A total of £350, so a buyer paying over £350 for the bond is locking in a loss in nominal terms - ie they receive less cash from the bond than they paid out for it. Until the recent Central Bank Quantative Easing in response to the 2008-9 crash, it was almost unheard of for people to make nominal losses by buying and holding to maturity a bond whose issuer made all the payments in full and on time. How could it ever make sense to buy a bond with a negative yield? The short answer is that, if the world is falling apart, banks look shaky, so you don’t want to leave your money with them, and holding significant sums of cash in banknotes is not an attractive option (either because it is not legal, or because you don’t trust the government not to pull an Indian ‘Demonetisation.’ trick), you might find locking in a small loss on eg a Swiss government bond was the least bad option.

A more usual way to make a loss investing in bonds is to buy a bond assuming that the issuer is a good credit risk, and/or that there is enough collateral backing it to cover payments in the event of default. If you do not seriously consider the risk of default, and attach a suitable price to that risk, then you are likely to pay too much for the bond. ie you end up buying a risky bond for almost as much as you would have paid for a low-risk bond (US Treasury, UK gilt, etc). Financial history is littered with examples of fortunes lost on this way.

In the 1970s banks became enthusiastic about lending to Latin American governments, seduced by the idea that ‘countries don’t go out of business’, and reassured there was no currency risk as the debt was denominated in US dollars.

When those governments ceased to be able to pay their bills, the subsequent ‘restructuring’ and write offs are estimated to have caused US banks losses equal to their entire previous trading profits (ie decades years of home grown profits lost within a few years by making overly optimistic assumptions about an area they didn’t know as well as they thought they did).

The 1980s US savings and loan crisis was caused by banks lending money against underlying property that they thought was worth more than the loan, but when it came to foreclosure sales they found that it was worth rather less.

The 2000 ‘.com bubble’ and subsequent burst, was largely an equity phenomenon (and will be covered in the chapter on equities) but also extended to bonds. Companies like Nokia, Nortel, Enron, and WorldCom issuer billions of dollars of bonds, bought by investors who thought the risk of default negligible. But default they did.

The 2008-9 crash saw US mortgage bonds that the ratings agencies had marked AAA suddenly trading at 50-60 cents on the dollar[3]. While in Europe’s ‘Euro area’ investors (including banks encouraged to do so by their regulators) discover that euro-denominated government bonds issued by Greece & other ‘club med’ countries were not the same as euro denominated bonds issued by Germany or Holland. Greek government debt was ‘restructured’ several times, each ‘restructuring’ involving investors having to accept they would be paid less and paid later than they had expected.

A common characteristic of the sovereign (government) defaults / restructuring above is that it involved bonds that were not denominated in a fiat (paper) currency controlled by the country’s central bank. Where the currency is controlled by the country concerned (as is the case with US treasuries denominated in US dollars, UK gilts denominated in sterling, JGBs denominated in Yen, and, arguably German bunds denominated in Euros) absolute default seldom occurs as the government has the option of printing more money to pay its debts. That is what Zimbabwe and Venezuela have done, but the lack of default has not protected investors because, as proved most notoriously by 1920s Weimar Germany, when governments start doing this, it triggers inflation, potentially hyperinflation that makes the cash received worthless. Or, as Alan Greenspan, the late 20th Centaury Federal Reserve Chairman said "We can guarantee cash, but we cannot guarantee purchasing power!"

That leads neatly on to another common way of loosing money by investing in bonds: holding bonds, especially long dated bonds, at a time when inflation picks up. While the extreme example of hyperinflation is what makes this obvious without doing any modelling or calculations, don’t think that the relative rareness of hyperinflation makes inflation a largely academic risk. During the 1970s & early 1980s most of the western world, including the UK, USA, France, and Germany experienced consistent double digit inflation. This devastated many people who held UK gilts issued in pre-inflationary times, particularly holders of 3% Consols that had originally been due for repayment in the early 1940s. As there was a war on, the government appealed to holders not to insist on repayment and instead allow the bonds to become ‘perpetual’ - ie to keep paying the 3% coupon but never have the capital repaid. These undated bonds ended up trading at c30p in the pound, a nominal loss of c70% but in real terms a far bigger loss as that 30p would buy considerably less than 30p would have in 1940. To be precise 30p in 1985 had the purchasing power of 2p in 1945. A 98% loss of value.

Investing in ‘Junk’ (‘high yield’) bonds is a potentially lucrative game, but substantial profits are usually confined to two situations: ‘valuable default’ and ‘deeply discounted purchase’. Michael Milken in the 1980s made money by buying bonds of companies in distress, and then calling in the loans when the companies defaulted: default caused the shareholders to be wiped out, while the bondholders took control of the company. Such a strategy is not open to small retail investors. Milken was often able to buy bonds at a significant discount to the issue price: when a company looks unlikely to repay a bond when it falls due, pessimistic bondholders may accept 70p in the pound, or 28p in the pound, or less. When buying at such a price, if default does not occur, or if default hands the bondholders collateral worth anything like the face value of the bond, you may reap considerable rewards.

Bonds: A quick Summary

1. Don't pay a manager to invest your money in bonds, unless you believe that they are honest, brighter than you are, and can only prosper if they deliver you successful results (see Investment managers)

2. Don't invest in bonds that guarantee you a loss (a negative yield to maturity)

3. Don’t accept the risk of loss, unless you are getting paid well to take that risk. The risk of loss, for which you need to be paid well, will come from

a. Increases in the rate of interest/inflation during the life of the bond (long dated bonds of 30+ years are likely to see quite a few changes during their lifetime: are you being paid enough to take that risk?)

b. The borrower being unable to pay you the interest due, or to return the capital on maturity (unless there is enough collateral / security backing the bond, but be VERY careful as, in depressions, when you most need collateral, you are most likely to find that they are worth less than as initially assumed)

Collateralized Debt Obligations (CDOs), Collateralized Loan Obligations (CLOs), etc

Lewi Raneri was a genius, when he created Mortgage Bonds, he performed a useful service. But subsequent refinements of his ideas, and ever more complex product engineering, have often benefited only the financial institutions creating the products. If you fully understand the products, and believe that they offer you great value, by all means go ahead, but allow the details below to arm you with extra skepticism.

I first came across CDOs in the early 1990s when a friend was working for a boutique selling the things to small European banks. A CDO was a collection of receivables that could be from almost anywhere: credit card payments, cash from prepayment meters, loans to amusement arcades, business loans to dentists, commercial property bridging loans. You get the idea. It was a rag-tag of IOUs that the CDO issuer would collect from the underlying debtors, and pass on to the owner of the CDO. CDOs were bought by German landersbanks, and other banks not known for their investment banking operations. The truly astonishing element of these 1990s CDOs was that the issuing institutions did not disclose what was in the product: buyers got an undefined ‘something’ that, if all went well would give them a defined cashflow. I was astonished that anyone at all, let alone a bank, would pay tens of millions of pounds without making any assessment of the credit risk involved. Less surprising was that the firm was based in expensive Mayfair offices and referred to the Gavroche (one of London’s highest profile and most overpriced restaurants) as the ‘staff canteen’

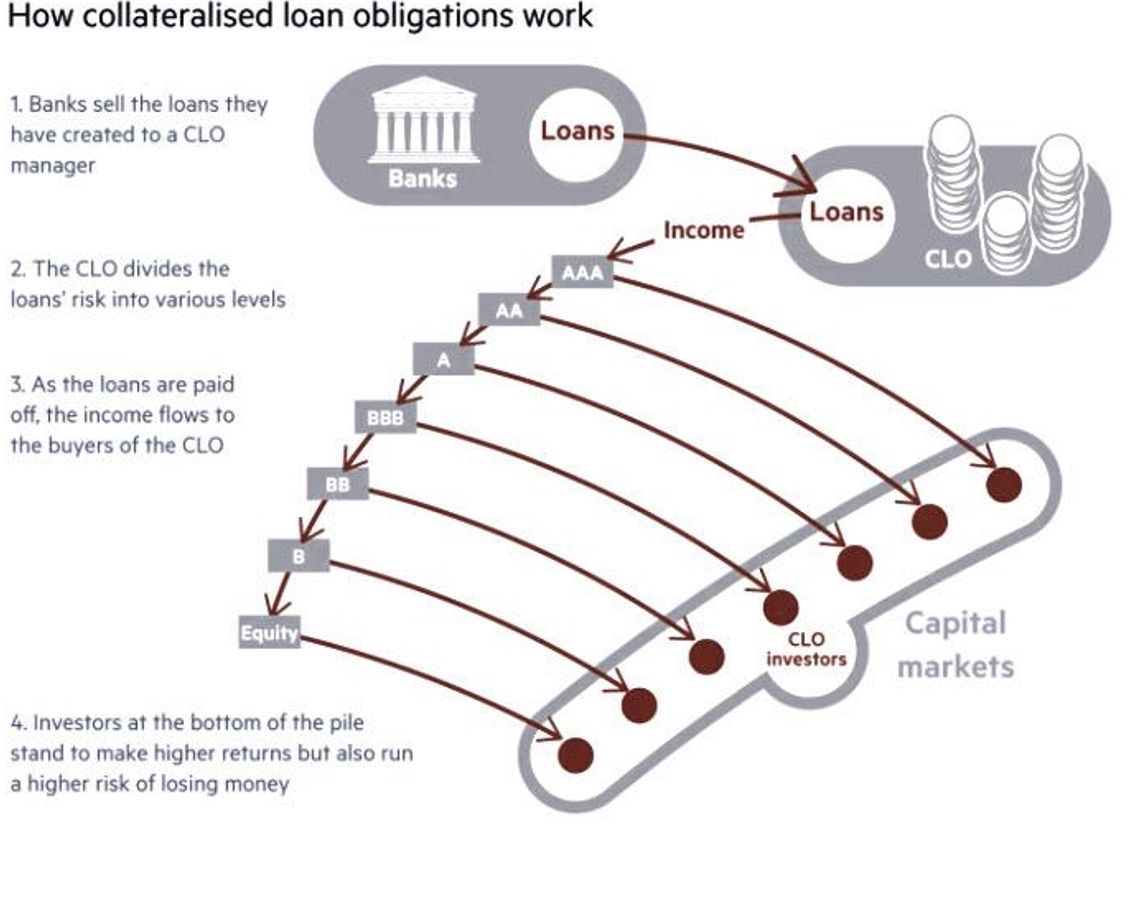

More recently, Zero Hedge[4] produced a primer on CLOs, Collateralised Loan Obligations, which are a type of CDO where the debt concerned is made up of bank loans.

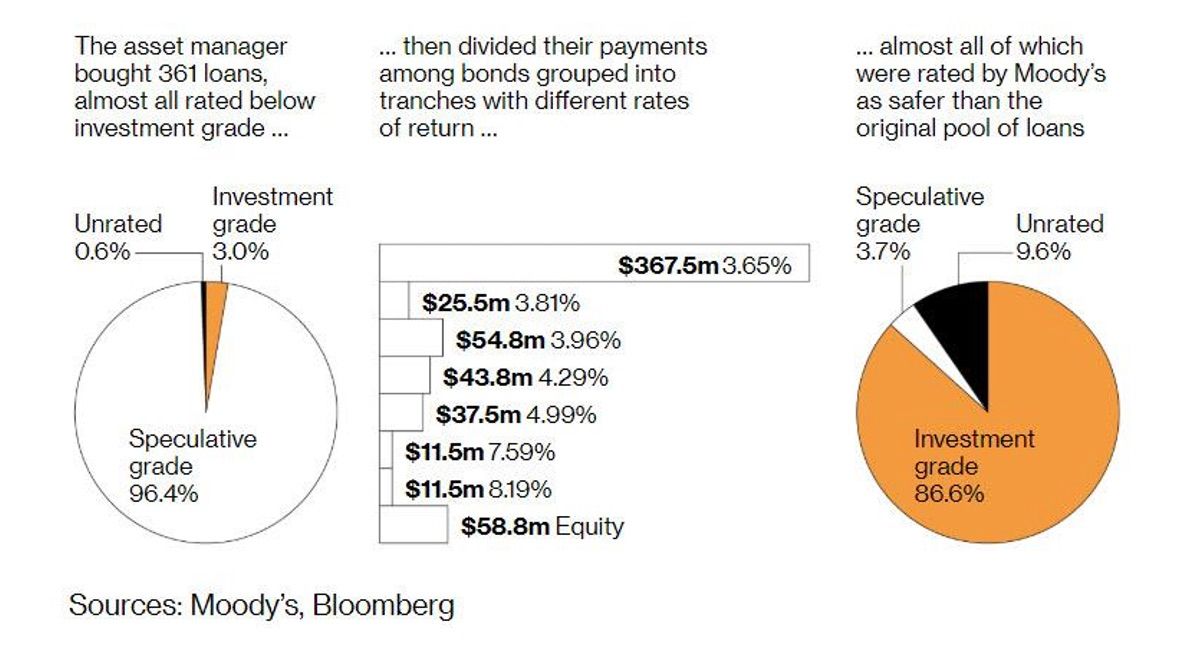

Take the example of the 2017 Long Point Park CLO. As part of the CLO process, the asset manager bought 361 loans worth $610 million, of which over 96% were rated junk. Having thus compiled a pool of almost entirely junk-rated loans, the manager then divided the scheduled payments from the CLO into tranches offering declining safety and increasing rates of return - starting at the top with AAA, then dropping to AA and so on, all that way to BBB, BB and B, before concluding with the riskiest, equity tranche, at the bottom. In such a way, 361 current-pay junk-rated loans were used to create a synthetic cap table, with the least risky on top and most risky at the bottom.

And here is the alchemy itself: since everything above the BB bond is by definition investment grade, this meant that a portfolio of mostly junk debt, thanks to the "magic" of CLO transformation which is also the process where investors collectively agree that the naked emperor is, in fact, dressed, ended up rated investment grade. In fact, as shown in the chart below, the original pool of a 96.4% junk-rated loans, was transformed into 86.6% investment grade synthetic bonds, and just 3.7% of the resulting "bonds" were rated speculative grade, or the same rating as the original assets!

Just like that, the Wall Street structured credit machine has converted a portfolio of 96.4% junk-rated loans into bonds that are just 3.7% junk rated, with 87% rated investment grade through the magic of "diversification", even though all those synthetic "investment grade" bonds have as collateral junk assets which are all effectively worthless during a systemic crisis.

And here is where the perfect coronavirus storm came into play.

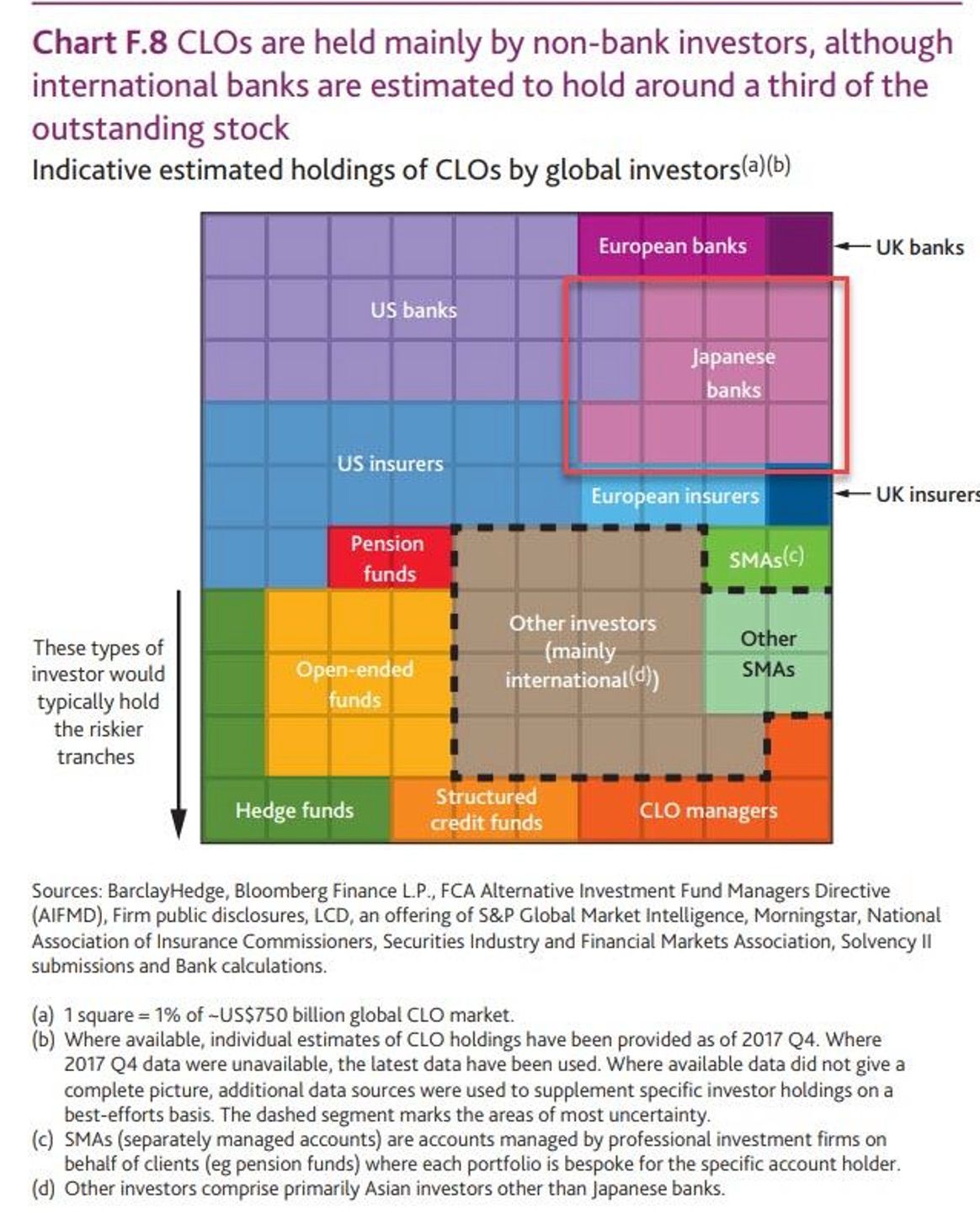

Thanks to the law of large numbers and simple statistics, when aggregated across a large enough number of loans, defaults become a perfectly predictable and mundane event where one can easily extrapolate both cumulative losses and severity given a set of economic conditions. That's precisely why investors then end up buying any given CLO tranche: given an investor's risk tolerance and assumptions about marginal changes in the global economy, a risk-tolerant investor such as a hedge fund, who believes an economic slowdown is nowhere near, can buy the lowly-rated B note and earn a respectable yield. Other, more risk-averse investors - such as Japanese pensioners or UK insurers - end up buying the AAA or AA rated tranches, as these effectively guarantee no impairments, absent some unprecedented shock.

As with the NINJA (No Income, No Jobs, No Assets) borrowers behind the riskiest mortgage bonds profiled in ‘The Big Short’, those Bonds, which blew up in the 2008-9 credit crunch, and these new CLOs blowing up due to corona virus, are not something from the dark periphery of finance. They are mainstream, and fully endorsed by all the usual ‘grown ups’. Consider the ratings agencies: You might have thought that they would have learned from the credit crunch, but the problem is that this is a US$750 Billion market, which means that every 0.1% they can make in fees to issuers is worth US$750 million. The UC Berkley Haas institute[5] drew me to an amazing analysis

CDOs come under the ‘Structured’ class. Initially Aaa rated structured products have a 3.64% default rate. The comparable rate for initially Aaa Corporate bonds is 0.16%. The Aaa rated structured product has a default rate somewhere between a Corporate bond rated Baa (1.69%) and Ba (7.52%).

Who would want an Aa rated structured product (20.21% default) over a B rated Corporate bond with similar (21.30%) default rate? In a rational market, people might choose the structured product if it offered a higher rate of interest, or better collateral in the event of default, but the whole magic of the structuring (at least for the firm doing the structuring) is that the investment grade Aa credit rating achieved allows the product to be sold with a lower yield than the market demands of B rated junk bonds. So, we are left with two main groups of such buyer:

a) Those that have not done the analysis and don’t realize that the CLO with a rating of Aaa is actually equivalent to a B rated junk bond

b) Those bound by regulators to invest only in ‘investment grade’ securities

Once again, financial quicksand awaits those that rely on regulators, rating agencies, and similar ‘grown ups’. Regulators really do tell some institutions that they can invest in structured products that have a notional ‘A’ rating, while banning them from non-A rated bonds which are actually far less risky.

[1] Actually, as the house is now worth £130,000, before choosing to repossess, the bank might let the borrower remortgage which would fund a couple of years more interest payments

[2]If inflation was below the interest rate on the mortgage, money might even be made in real terms.

[3] Some sub prime bonds issued in 2007 came to trade for 2 cents on the dollar. https://www.bloomberg.com/news/articles/2018-10-01/beaten-down-subprime-mortgage-bonds-offered-a-decade-of-gains

[4] https://www.zerohedge.com/markets/modern-alchemy-how-wall-street-converts-portfolio-96-junk-loans-87-investment-grade-bonds